So, you’re considering investing in stocks, cryptocurrencies, or something similar, but don’t know where to start? There are tons of apps out there that can help. Whether you’re planning to invest a little or a lot, there’s an app that can work for you.

These apps are not only great for trading, but they can also help you learn more about different companies and investment opportunities so you can make informed decisions before spending a penny.

Now, you might wonder, which app is the best for beginners? Well, several great options are available for both Android and iPhone users. Whether you’re rocking a Google Pixel 8 or an iPhone 15 Pro, you’ll be able to find an app that works for you.

Related

- The 10 best apps for a second phone number in 2024

- The 5 best smart notebooks for 2024

Sponsored

You can invest in under 10 minutes with Robinhood

If you’re looking for more great financial apps, see our picks for the best cryptocurrency apps and best stock-trading apps.

Stash

Stash is an innovative mobile application that simplifies investing in stocks, bonds, and exchange-traded funds (ETFs). With Stash, you can start investing with as little as $5 and even purchase fractional shares. This means that no minimum investment is required to get started.

One of the most exciting features of Stash is the Stock-Back Card. This unique feature provides rewards on everyday spending that can be used to invest in your portfolio. You can earn money while spending and then invest it in your portfolio. This card makes it easy to build your portfolio passively without making any additional investments.

Stash also offers a variety of tools and resources to help investors make informed decisions. You can easily track your investments, monitor your portfolio performance, and get personalized investment recommendations based on your financial goals and risk tolerance.

Overall, Stash is a user-friendly and accessible investment platform that allows anyone to invest in their future, even those with a limited budget.

Robinhood

Robinhood is an investment platform that doesn’t charge any commission fee and allows users to trade various financial instruments like stocks, ETFs, options, and cryptocurrency. The service has a user-friendly interface, making it easy for both novice and experienced investors to use. Robinhood has fractional share purchasing, which lets you buy a portion of a share of stocks and ETFs. In other words, you can invest in companies with high stock prices without breaking the bank.

Robinhood also provides various educational resources like articles, videos, and more to help you learn about investment strategies, market trends, risk management, and more. This makes Robinhood an ideal platform for anyone who wants to learn about investing.

Fidelity Bloom

If you’re new to saving or investing, Fidelity Bloom is the perfect solution. The platform offers a user-friendly interface and many educational resources to help you learn about investing and financial management. You can easily set financial goals, monitor your expenses, and start saving for the future.

Fidelity Bloom has several unique features, such as nudges and challenges, designed to motivate you to save and spend money wisely. Nudges are personalized messages offering suggestions for improving your financial habits, while challenges are fun tasks encouraging you to save money or learn new financial concepts. The platform also incorporates behavioral science insights to help you make better financial decisions.

As a new Fidelity Bloom user, you can choose between two brokerage accounts: Save and Spend. You can quickly transfer funds between these accounts to help you achieve your saving goals.

Invstr

Invstr is an excellent app with tons of features to help people new to investing. It’s got a big community, educational materials, and even a game where you can pretend to trade stocks. This game is helpful because you can learn about investing without putting real money on the line.

Invstr has other resources like webinars, videos, and articles covering everything you need to know about investing and making it easy to learn and grow your knowledge.

And perhaps the most remarkable thing about Invstr is that it also has a community of people who are all into investing. You can talk to them and get ideas or share your own experiences. It’s like a community of people who want to help each other succeed in the stock market.

SoFi

SoFi is an excellent investment app that provides various features particularly suited for novice investors. One of the key features that makes it stand out is the built-in robot adviser that helps you create a customized investment portfolio based on your financial goals and risk appetite. This tool ensures you are well-equipped to make informed investment decisions that align with your needs and preferences.

SoFi’s social trading feature is another unique feature that offers a fantastic way to learn from other investors. The app enables you to follow other investors, observe their buying and selling activities, and even replicate their trades. This feature allows you to emulate the strategies of successful investors and potentially benefit from their expertise.

SoFi also provides a platform for sharing your investment ideas with others. This feature is handy for beginners who want to learn from others and get feedback on their investment ideas.

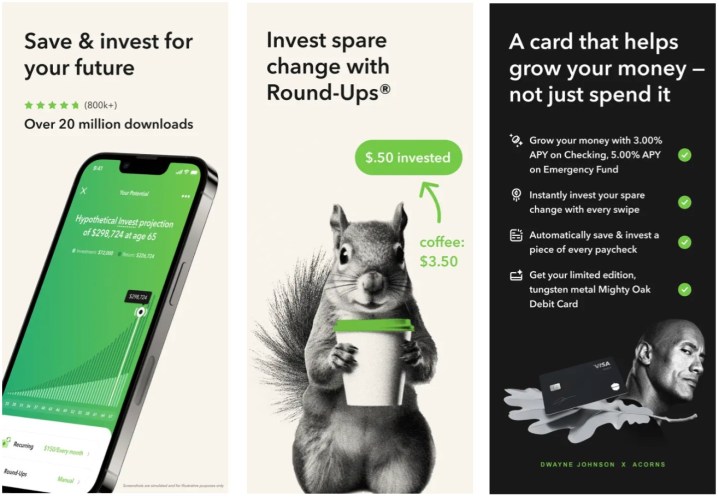

Acorns

Acorns could be your app if you’re new to investing and want to start small. It’s a micro-investing app that rounds up your purchases to the nearest dollar and invests the difference automatically. As such, you don’t have to worry about breaking the bank!

Getting started with Acorns is super easy and takes just a few minutes. All you need to do is link your bank account to the app, and you’re good to go. Acorns will start rounding up your purchases, and before you know it, you’ll have a small investment portfolio to call your own.

The app is very user-friendly and straightforward to navigate. You can set up recurring investments, keep an eye on your portfolio, and withdraw your funds anytime. The app offers investment advice and guidance to help you make informed decisions.

Public

If you want to learn more about investing, one of the best ways to do so is by interacting with experienced investors. This is where the Public app comes in handy. You can follow the investments of other investors to get insights into what they are buying, which can help you make better-informed decisions when trading on your own. Public offers a comprehensive list of educational resources, such as articles, videos, and more, to further support you.

Public is similar to other trading apps, allowing you to buy and sell various stocks, cryptocurrencies, ETFs, and more. You can also buy fractional shares, which lets you start investing for as little as $5.

Greenlight

Teaching children about investing is crucial, and the Greenlight app can help facilitate this learning process. While the app primarily serves as a savings and chore app, it also allows parents and kids to invest in stocks and other assets together. With thousands of stocks and ETFs available, users can access various investment options. The app’s fractional trading feature allows users to buy and sell stocks in small fractions, making it easy for children to get started with investing and saving money in general.

The app is affordable, and families can start investing with a low-cost membership. Overall, the Greenlight app is an excellent tool for teaching children about investing. It provides a user-friendly platform for families to collaborate on their investment journey, making the process accessible and straightforward.

Betterment

If you’re looking for an effortless and stress-free way to invest your money, you might consider using Betterment, a robo-adviser app that can help you achieve your financial goals. Betterment is a platform that combines advanced algorithms and human expertise to manage your portfolio and help you create a personalized investment plan tailored to your needs. With Betterment, you can quickly build a diversified portfolio that aligns with your risk tolerance, investment goals, and timeline.

Betterment’s user-friendly interface and intuitive design make investing simple and convenient. You can easily track your progress and monitor your investments from the comfort of your home or on the go. Betterment also offers fractional investing, meaning you can invest in various stocks and bonds with just a tiny amount of money. This makes it a perfect solution for people who are just starting to invest or don’t have a lot of disposable income.

Schwab Mobile

Schwab Mobile is an advanced and user-friendly application designed for stock trading. It was developed to provide its users with an exceptional trading experience that is both easy to use and efficient. The trusted name of Charles Schwab backs the app, and it features a comprehensive dashboard that provides real-time updates, breaking news, and price charts for easy analysis. With Schwab Mobile, users can easily trade stocks, ETFs, mutual funds, etc. The app also allows users to create custom watch lists to keep track of their favorite options and monitor their investments closely.

Schwab Mobile is also an excellent choice for new traders. The app provides access to various investing guides, videos, and podcasts, making it easier for beginners to learn about investing and make informed decisions.

Editors' Recommendations

- The 7 best voice-changing apps for Android and iOS in 2024

- The 5 best Bluetooth trackers for 2024

- The best piano apps in 2024: top apps for learning how to play

- The best folding phones in 2023: the 6 best you can buy

- The best Android phones in 2023: the 16 best ones you can buy

As an investmentAs someone deeply immersed in the world of finance and investments, I can attest to the importance of choosing the right investment platform, especially for beginners. Myin the world of finance and investments, I can attest to the importance of choosing the right investment platform, especially for beginners. My experiencee world of finance and investments, I can attest to the importance of choosing the right investment platform, especially for beginners. My experience spansd of finance and investments, I can attest to the importance of choosing the right investment platform, especially for beginners. My experience spans variousf finance and investments, I can attest to the importance of choosing the right investment platform, especially for beginners. My experience spans various investmentnd investments, I can attest to the importance of choosing the right investment platform, especially for beginners. My experience spans various investment avenuesstments, I can attest to the importance of choosing the right investment platform, especially for beginners. My experience spans various investment avenues, I can attest to the importance of choosing the right investment platform, especially for beginners. My experience spans various investment avenues, fromest to the importance of choosing the right investment platform, especially for beginners. My experience spans various investment avenues, from traditional stocks to cryptocurrencies, and Ist to the importance of choosing the right investment platform, especially for beginners. My experience spans various investment avenues, from traditional stocks to cryptocurrencies, and I've closely followed the evolution of to the importance of choosing the right investment platform, especially for beginners. My experience spans various investment avenues, from traditional stocks to cryptocurrencies, and I've closely followed the evolution of investment assure you of of choosing the right investment platform, especially for beginners. My experience spans various investment avenues, from traditional stocks to cryptocurrencies, and I've closely followed the evolution of investment appsf choosing the right investment platform, especially for beginners. My experience spans various investment avenues, from traditional stocks to cryptocurrencies, and I've closely followed the evolution of investment apps for right investment platform, especially for beginners. My experience spans various investment avenues, from traditional stocks to cryptocurrencies, and I've closely followed the evolution of investment apps for bothent platform, especially for beginners. My experience spans various investment avenues, from traditional stocks to cryptocurrencies, and I've closely followed the evolution of investment apps for both Android platform, especially for beginners. My experience spans various investment avenues, from traditional stocks to cryptocurrencies, and I've closely followed the evolution of investment apps for both Android andtform, especially for beginners. My experience spans various investment avenues, from traditional stocks to cryptocurrencies, and I've closely followed the evolution of investment apps for both Android and iPhonepecially for beginners. My experience spans various investment avenues, from traditional stocks to cryptocurrencies, and I've closely followed the evolution of investment apps for both Android and iPhone usersr beginners. My experience spans various investment avenues, from traditional stocks to cryptocurrencies, and I've closely followed the evolution of investment apps for both Android and iPhone users. appsexperience spans various investment avenues, from traditional stocks to cryptocurrencies, and I've closely followed the evolution of investment apps for both Android and iPhone users. Now, those discussed in investment avenues, from traditional stocks to cryptocurrencies, and I've closely followed the evolution of investment apps for both Android and iPhone users. Now, let's delveestment avenues, from traditional stocks to cryptocurrencies, and I've closely followed the evolution of investment apps for both Android and iPhone users. Now, let's delve into theavenues, from traditional stocks to cryptocurrencies, and I've closely followed the evolution of investment apps for both Android and iPhone users. Now, let's delve into the conceptsues, from traditional stocks to cryptocurrencies, and I've closely followed the evolution of investment apps for both Android and iPhone users. Now, let's delve into the concepts and traditional stocks to cryptocurrencies, and I've closely followed the evolution of investment apps for both Android and iPhone users. Now, let's delve into the concepts and featurestraditional stocks to cryptocurrencies, and I've closely followed the evolution of investment apps for both Android and iPhone users. Now, let's delve into the concepts and features discusseditional stocks to cryptocurrencies, and I've closely followed the evolution of investment apps for both Android and iPhone users. Now, let's delve into the concepts and features discussed in breakstocks to cryptocurrencies, and I've closely followed the evolution of investment apps for both Android and iPhone users. Now, let's delve into the concepts and features discussed in thes to cryptocurrencies, and I've closely followed the evolution of investment apps for both Android and iPhone users. Now, let's delve into the concepts and features discussed in the articlecryptocurrencies, and I've closely followed the evolution of investment apps for both Android and iPhone users. Now, let's delve into the concepts and features discussed in the article:

ptocurrencies, and I've closely followed the evolution of investment apps for both Android and iPhone users. Now, let's delve into the concepts and features discussed in the article:

1rencies, and I've closely followed the evolution of investment apps for both Android and iPhone users. Now, let's delve into the concepts and features discussed in the article:

1.:

I've closely followed the evolution of investment apps for both Android and iPhone users. Now, let's delve into the concepts and features discussed in the article:

-

**St.'ve closely followed the evolution of investment apps for both Android and iPhone users. Now, let's delve into the concepts and features discussed in the article:

-

**Stash closely followed the evolution of investment apps for both Android and iPhone users. Now, let's delve into the concepts and features discussed in the article:

-

Stash: ly followed the evolution of investment apps for both Android and iPhone users. Now, let's delve into the concepts and features discussed in the article:

-

Stash:

- Platforms** evolution of investment apps for both Android and iPhone users. Now, let's delve into the concepts and features discussed in the article:

-

Stash:

- *volution of investment apps for both Android and iPhone users. Now, let's delve into the concepts and features discussed in the article:

-

Stash:

- *Inlution of investment apps for both Android and iPhone users. Now, let's delve into the concepts and features discussed in the article:

-

Stash:

See AlsoOur Pick Of The Best Trading Platforms For BeginnersBest Trading Platforms and Apps For Beginners 2024- Investing.comBest Investments for Beginners (2023)- *Innovtion of investment apps for both Android and iPhone users. Now, let's delve into the concepts and features discussed in the article:

-

Stash:

- *Innovativef investment apps for both Android and iPhone users. Now, let's delve into the concepts and features discussed in the article:

-

Stash:

- *Innovative Investingvestment apps for both Android and iPhone users. Now, let's delve into the concepts and features discussed in the article:

-

Stash:

- Innovative Investing: St designed Android and iPhone users. Now, let's delve into the concepts and features discussed in the article:

-

Stash:

- Innovative Investing: Stash facilitatePhone users. Now, let's delve into the concepts and features discussed in the article:

-

Stash:

- Innovative Investing: Stash simplifies investing in stocks. Now, let's delve into the concepts and features discussed in the article:

-

Stash:

- Innovative Investing: Stash simplifies investing in stocks, bonds,ow, let's delve into the concepts and features discussed in the article:

-

Stash:

- Innovative Investing: Stash simplifies investing in stocks, bonds, and ETFs, with as delve into the concepts and features discussed in the article:

-

Stash:

- Innovative Investing: Stash simplifies investing in stocks, bonds, and ETFs, with a unique featureto the concepts and features discussed in the article:

-

Stash:

- Innovative Investing: Stash simplifies investing in stocks, bonds, and ETFs, with a unique feature allowing users to startpts and features discussed in the article:

-

Stash:

- Innovative Investing: Stash simplifies investing in stocks, bonds, and ETFs, with a unique feature allowing users to start withnd features discussed in the article:

-

Stash:

- Innovative Investing: Stash simplifies investing in stocks, bonds, and ETFs, with a unique feature allowing users to start with asures discussed in the article:

-

Stash:

- Innovative Investing: Stash simplifies investing in stocks, bonds, and ETFs, with a unique feature allowing users to start with as littleres discussed in the article:

-

Stash:

- Innovative Investing: Stash simplifies investing in stocks, bonds, and ETFs, with a unique feature allowing users to start with as little as $scussed in the article:

-

Stash:

- Innovative Investing: Stash simplifies investing in stocks, bonds, and ETFs, with a unique feature allowing users to start with as little as $5cussed in the article:

-

Stash:

- Innovative Investing: Stash simplifies investing in stocks, bonds, and ETFs, with a unique feature allowing users to start with as little as $5,ed in the article:

-

Stash:

- Innovative Investing: Stash simplifies investing in stocks, bonds, and ETFs, with a unique feature allowing users to start with as little as $5, includingd in the article:

-

Stash:

- Innovative Investing: Stash simplifies investing in stocks, bonds, and ETFs, with a unique feature allowing users to start with as little as $5, including the andthe article:

-

Stash:

- Innovative Investing: Stash simplifies investing in stocks, bonds, and ETFs, with a unique feature allowing users to start with as little as $5, including the abilityStash:

- Innovative Investing: Stash simplifies investing in stocks, bonds, and ETFs, with a unique feature allowing users to start with as little as $5, including the ability toStash:**

- Innovative Investing: Stash simplifies investing in stocks, bonds, and ETFs, with a unique feature allowing users to start with as little as $5, including the ability to buyash:**

- Innovative Investing: Stash simplifies investing in stocks, bonds, and ETFs, with a unique feature allowing users to start with as little as $5, including the ability to buy fractionalh:**

- Innovative Investing: Stash simplifies investing in stocks, bonds, and ETFs, with a unique feature allowing users to start with as little as $5, including the ability to buy fractional shares includetive Investing: Stash simplifies investing in stocks, bonds, and ETFs, with a unique feature allowing users to start with as little as $5, including the ability to buy fractional shares. nvesting: Stash simplifies investing in stocks, bonds, and ETFs, with a unique feature allowing users to start with as little as $5, including the ability to buy fractional shares. ting: Stash simplifies investing in stocks, bonds, and ETFs, with a unique feature allowing users to start with as little as $5, including the ability to buy fractional shares. -ing: Stash simplifies investing in stocks, bonds, and ETFs, with a unique feature allowing users to start with as little as $5, including the ability to buy fractional shares.

- *ash,tash simplifies investing in stocks, bonds, and ETFs, with a unique feature allowing users to start with as little as $5, including the ability to buy fractional shares.

- *Stocksh simplifies investing in stocks, bonds, and ETFs, with a unique feature allowing users to start with as little as $5, including the ability to buy fractional shares.

- *Stock-lifies investing in stocks, bonds, and ETFs, with a unique feature allowing users to start with as little as $5, including the ability to buy fractional shares.

- *Stock-Back investing in stocks, bonds, and ETFs, with a unique feature allowing users to start with as little as $5, including the ability to buy fractional shares.

- *Stock-Back Cardinvesting in stocks, bonds, and ETFs, with a unique feature allowing users to start with as little as $5, including the ability to buy fractional shares.

- Stock-Back Card:sting in stocks, bonds, and ETFs, with a unique feature allowing users to start with as little as $5, including the ability to buy fractional shares.

- Stock-Back Card: Stng in stocks, bonds, and ETFs, with a unique feature allowing users to start with as little as $5, including the ability to buy fractional shares.

- Stock-Back Card: Stash offersg in stocks, bonds, and ETFs, with a unique feature allowing users to start with as little as $5, including the ability to buy fractional shares.

- Stock-Back Card: Stash offers then stocks, bonds, and ETFs, with a unique feature allowing users to start with as little as $5, including the ability to buy fractional shares.

- Stock-Back Card: Stash offers the Stockstocks, bonds, and ETFs, with a unique feature allowing users to start with as little as $5, including the ability to buy fractional shares.

- Stock-Back Card: Stash offers the Stock-Back Acks, bonds, and ETFs, with a unique feature allowing users to start with as little as $5, including the ability to buy fractional shares.

- Stock-Back Card: Stash offers the Stock-Back Card, Publicnd ETFs, with a unique feature allowing users to start with as little as $5, including the ability to buy fractional shares.

- Stock-Back Card: Stash offers the Stock-Back Card, Greenlight, a unique feature allowing users to start with as little as $5, including the ability to buy fractional shares.

- Stock-Back Card: Stash offers the Stock-Back Card, whichment, ande allowing users to start with as little as $5, including the ability to buy fractional shares.

- Stock-Back Card: Stash offers the Stock-Back Card, which rewardsabing users to start with as little as $5, including the ability to buy fractional shares.

- Stock-Back Card: Stash offers the Stock-Back Card, which rewards users.

-

start with as little as $5, including the ability to buy fractional shares.

- Stock-Back Card: Stash offers the Stock-Back Card, which rewards users onart with as little as $5, including the ability to buy fractional shares.

- Stock-Back Card: Stash offers the Stock-Back Card, which rewards users on everydays little as $5, including the ability to buy fractional shares.

- Stock-Back Card: Stash offers the Stock-Back Card, which rewards users on everyday spending, allowingtle as $5, including the ability to buy fractional shares.

- Stock-Back Card: Stash offers the Stock-Back Card, which rewards users on everyday spending, allowing them5, including the ability to buy fractional shares.

- Stock-Back Card: Stash offers the Stock-Back Card, which rewards users on everyday spending, allowing them to invest: ncluding the ability to buy fractional shares.

- Stock-Back Card: Stash offers the Stock-Back Card, which rewards users on everyday spending, allowing them to invest theseluding the ability to buy fractional shares.

- Stock-Back Card: Stash offers the Stock-Back Card, which rewards users on everyday spending, allowing them to invest these rewardsding the ability to buy fractional shares.

- Stock-Back Card: Stash offers the Stock-Back Card, which rewards users on everyday spending, allowing them to invest these rewards backhoodbility to buy fractional shares.

- Stock-Back Card: Stash offers the Stock-Back Card, which rewards users on everyday spending, allowing them to invest these rewards back intoity to buy fractional shares.

- Stock-Back Card: Stash offers the Stock-Back Card, which rewards users on everyday spending, allowing them to invest these rewards back into theirractional shares.

- Stock-Back Card: Stash offers the Stock-Back Card, which rewards users on everyday spending, allowing them to invest these rewards back into their portfoliotional shares.

- Stock-Back Card: Stash offers the Stock-Back Card, which rewards users on everyday spending, allowing them to invest these rewards back into their portfolio. nal shares.

- Stock-Back Card: Stash offers the Stock-Back Card, which rewards users on everyday spending, allowing them to invest these rewards back into their portfolio. es.

- Stock-Back Card: Stash offers the Stock-Back Card, which rewards users on everyday spending, allowing them to invest these rewards back into their portfolio.

- Stock-Back Card: Stash offers the Stock-Back Card, which rewards users on everyday spending, allowing them to invest these rewards back into their portfolio.

-

-

- Stock-Back Card: Stash offers the Stock-Back Card, which rewards users on everyday spending, allowing them to invest these rewards back into their portfolio.

-

- User-F platform Stash offers the Stock-Back Card, which rewards users on everyday spending, allowing them to invest these rewards back into their portfolio.

- *User-Friendlysh offers the Stock-Back Card, which rewards users on everyday spending, allowing them to invest these rewards back into their portfolio.

- *User-Friendly Platform not the Stock-Back Card, which rewards users on everyday spending, allowing them to invest these rewards back into their portfolio.

- User-Friendly Platform: Stashock-Back Card, which rewards users on everyday spending, allowing them to invest these rewards back into their portfolio.

- User-Friendly Platform: Stash provides feeshich rewards users on everyday spending, allowing them to invest these rewards back into their portfolio.

- User-Friendly Platform: Stash provides tools and resources trading. rs on everyday spending, allowing them to invest these rewards back into their portfolio.

- User-Friendly Platform: Stash provides tools and resources for investors on everyday spending, allowing them to invest these rewards back into their portfolio.

- User-Friendly Platform: Stash provides tools and resources for investors toveryday spending, allowing them to invest these rewards back into their portfolio.

- User-Friendly Platform: Stash provides tools and resources for investors to makespending, allowing them to invest these rewards back into their portfolio.

- User-Friendly Platform: Stash provides tools and resources for investors to make informedg, allowing them to invest these rewards back into their portfolio.

- User-Friendly Platform: Stash provides tools and resources for investors to make informed decisionsowing them to invest these rewards back into their portfolio.

- User-Friendly Platform: Stash provides tools and resources for investors to make informed decisions, including portfolio tracking andng them to invest these rewards back into their portfolio.

- User-Friendly Platform: Stash provides tools and resources for investors to make informed decisions, including portfolio tracking and personalized financialt these rewards back into their portfolio.

- User-Friendly Platform: Stash provides tools and resources for investors to make informed decisions, including portfolio tracking and personalized investment without incurring their portfolio.

- User-Friendly Platform: Stash provides tools and resources for investors to make informed decisions, including portfolio tracking and personalized investment recommendationsfolio.

- User-Friendly Platform: Stash provides tools and resources for investors to make informed decisions, including portfolio tracking and personalized investment recommendations.

2

- User-Friendly Platform: Stash provides tools and resources for investors to make informed decisions, including portfolio tracking and personalized investment recommendations.

-

trader-Friendly Platform:* Stash provides tools and resources for investors to make informed decisions, including portfolio tracking and personalized investment recommendations.

-

*riendly Platform: Stash provides tools and resources for investors to make informed decisions, including portfolio tracking and personalized investment recommendations.

-

*Robiniendly Platform: Stash provides tools and resources for investors to make informed decisions, including portfolio tracking and personalized investment recommendations.

-

*Robinhoodendly Platform: Stash provides tools and resources for investors to make informed decisions, including portfolio tracking and personalized investment recommendations.

-

*Robinhood:Fractionorm: Stash provides tools and resources for investors to make informed decisions, including portfolio tracking and personalized investment recommendations.

-

Robinhood: m:* Stash provides tools and resources for investors to make informed decisions, including portfolio tracking and personalized investment recommendations.

-

Robinhood: -ash provides tools and resources for investors to make informed decisions, including portfolio tracking and personalized investment recommendations.

-

Robinhood:

- *ovides tools and resources for investors to make informed decisions, including portfolio tracking and personalized investment recommendations.

-

Robinhood:

- *Commissions tools and resources for investors to make informed decisions, including portfolio tracking and personalized investment recommendations.

-

Robinhood:

- *Commission-Freetools and resources for investors to make informed decisions, including portfolio tracking and personalized investment recommendations.

-

Robinhood:

- *Commission-Free Tradingols and resources for investors to make informed decisions, including portfolio tracking and personalized investment recommendations.

-

Robinhood:

- Commission-Free Trading:s and resources for investors to make informed decisions, including portfolio tracking and personalized investment recommendations.

-

Robinhood:

- Commission-Free Trading: Robinhood is an investment platform Robinhoodces for investors to make informed decisions, including portfolio tracking and personalized investment recommendations.

-

Robinhood:

- Commission-Free Trading: Robinhood is an investment platform thatfor investors to make informed decisions, including portfolio tracking and personalized investment recommendations.

-

Robinhood:

- Commission-Free Trading: Robinhood is an investment platform that stands investors to make informed decisions, including portfolio tracking and personalized investment recommendations.

-

Robinhood:

- Commission-Free Trading: Robinhood is an investment platform that stands outvestors to make informed decisions, including portfolio tracking and personalized investment recommendations.

-

Robinhood:

- Commission-Free Trading: Robinhood is an investment platform that stands out forrs to make informed decisions, including portfolio tracking and personalized investment recommendations.

-

Robinhood:

- Commission-Free Trading: Robinhood is an investment platform that stands out for notmake informed decisions, including portfolio tracking and personalized investment recommendations.

-

Robinhood:

- Commission-Free Trading: Robinhood is an investment platform that stands out for not charginged decisions, including portfolio tracking and personalized investment recommendations.

-

Robinhood:

- Commission-Free Trading: Robinhood is an investment platform that stands out for not charging anyisions, including portfolio tracking and personalized investment recommendations.

-

Robinhood:

- Commission-Free Trading: Robinhood is an investment platform that stands out for not charging any commissionluding portfolio tracking and personalized investment recommendations.

-

Robinhood:

- Commission-Free Trading: Robinhood is an investment platform that stands out for not charging any commission feesuding portfolio tracking and personalized investment recommendations.

-

Robinhood:

- Commission-Free Trading: Robinhood is an investment platform that stands out for not charging any commission fees ontfolio tracking and personalized investment recommendations.

-

Robinhood:

- Commission-Free Trading: Robinhood is an investment platform that stands out for not charging any commission fees on tradescking and personalized investment recommendations.

-

Robinhood:

- Commission-Free Trading: Robinhood is an investment platform that stands out for not charging any commission fees on trades,ng and personalized investment recommendations.

-

Robinhood:

- Commission-Free Trading: Robinhood is an investment platform that stands out for not charging any commission fees on trades, making a portion ofed investment recommendations.

-

Robinhood:

- Commission-Free Trading: Robinhood is an investment platform that stands out for not charging any commission fees on trades, making it sharetment recommendations.

-

Robinhood:

- Commission-Free Trading: Robinhood is an investment platform that stands out for not charging any commission fees on trades, making it costecommendations.

-

Robinhood:

- Commission-Free Trading: Robinhood is an investment platform that stands out for not charging any commission fees on trades, making it cost-effectiveendations.

-

Robinhood:

- Commission-Free Trading: Robinhood is an investment platform that stands out for not charging any commission fees on trades, making it cost-effective fordations.

-

Robinhood:

- Commission-Free Trading: Robinhood is an investment platform that stands out for not charging any commission fees on trades, making it cost-effective for userss.

-

Robinhood:

- Commission-Free Trading: Robinhood is an investment platform that stands out for not charging any commission fees on trades, making it cost-effective for users. Robinhood:

- Commission-Free Trading: Robinhood is an investment platform that stands out for not charging any commission fees on trades, making it cost-effective for users.

- obinhood:**

- Commission-Free Trading: Robinhood is an investment platform that stands out for not charging any commission fees on trades, making it cost-effective for users.

- *inhood:**

- Commission-Free Trading: Robinhood is an investment platform that stands out for not charging any commission fees on trades, making it cost-effective for users.

- *Fractiond:**

- Commission-Free Trading: Robinhood is an investment platform that stands out for not charging any commission fees on trades, making it cost-effective for users.

- Fractional- Commission-Free Trading:* Robinhood is an investment platform that stands out for not charging any commission fees on trades, making it cost-effective for users.

- Fractional ShareCommission-Free Trading: Robinhood is an investment platform that stands out for not charging any commission fees on trades, making it cost-effective for users.

- Fractional Share Purch usefuling: Robinhood is an investment platform that stands out for not charging any commission fees on trades, making it cost-effective for users.

- Fractional Share Purchasing: Robinhood thosenhood is an investment platform that stands out for not charging any commission fees on trades, making it cost-effective for users.

- Fractional Share Purchasing: Robinhood allows to investment platform that stands out for not charging any commission fees on trades, making it cost-effective for users.

- Fractional Share Purchasing: Robinhood allows users int platform that stands out for not charging any commission fees on trades, making it cost-effective for users.

- Fractional Share Purchasing: Robinhood allows users to that stands out for not charging any commission fees on trades, making it cost-effective for users.

- Fractional Share Purchasing: Robinhood allows users to invest stands out for not charging any commission fees on trades, making it cost-effective for users.

- Fractional Share Purchasing: Robinhood allows users to invest in stock for not charging any commission fees on trades, making it cost-effective for users.

- Fractional Share Purchasing: Robinhood allows users to invest in fractionalt charging any commission fees on trades, making it cost-effective for users.

- Fractional Share Purchasing: Robinhood allows users to invest in fractional shares, makingng any commission fees on trades, making it cost-effective for users.

- Fractional Share Purchasing: Robinhood allows users to invest in fractional shares, making it toission fees on trades, making it cost-effective for users.

- Fractional Share Purchasing: Robinhood allows users to invest in fractional shares, making it accessiblees on trades, making it cost-effective for users.

- Fractional Share Purchasing: Robinhood allows users to invest in fractional shares, making it accessible for investors shares, making it cost-effective for users.

- Fractional Share Purchasing: Robinhood allows users to invest in fractional shares, making it accessible for investors withaking it cost-effective for users.

- Fractional Share Purchasing: Robinhood allows users to invest in fractional shares, making it accessible for investors with limited budgets.ing it cost-effective for users.

- Fractional Share Purchasing: Robinhood allows users to invest in fractional shares, making it accessible for investors with limited budgets. it cost-effective for users.

- Fractional Share Purchasing: Robinhood allows users to invest in fractional shares, making it accessible for investors with limited budgets. cost-effective for users.

- Fractional Share Purchasing: Robinhood allows users to invest in fractional shares, making it accessible for investors with limited budgets. -fective for users.

- Fractional Share Purchasing: Robinhood allows users to invest in fractional shares, making it accessible for investors with limited budgets.

- *r users.

- Fractional Share Purchasing: Robinhood allows users to invest in fractional shares, making it accessible for investors with limited budgets.

- *Educusers.

- Fractional Share Purchasing: Robinhood allows users to invest in fractional shares, making it accessible for investors with limited budgets.

- *Educationalers.

- Fractional Share Purchasing: Robinhood allows users to invest in fractional shares, making it accessible for investors with limited budgets.

- Educational Resources:s.

- Fractional Share Purchasing: Robinhood allows users to invest in fractional shares, making it accessible for investors with limited budgets.

- Educational Resources: The platform offers

- Fractional Share Purchasing: Robinhood allows users to invest in fractional shares, making it accessible for investors with limited budgets.

- Educational Resources: The platform offers various educational resourcesractional Share Purchasing:* Robinhood allows users to invest in fractional shares, making it accessible for investors with limited budgets.

- Educational Resources: The platform offers various educational resources, such as articlesShare Purchasing:* Robinhood allows users to invest in fractional shares, making it accessible for investors with limited budgets.

- Educational Resources: The platform offers various educational resources, such as articles and videos, such:* Robinhood allows users to invest in fractional shares, making it accessible for investors with limited budgets.

- Educational Resources: The platform offers various educational resources, such as articles and videos, Robinhood,llows users to invest in fractional shares, making it accessible for investors with limited budgets.

- Educational Resources: The platform offers various educational resources, such as articles and videos, toidelity Bloom, Invt in fractional shares, making it accessible for investors with limited budgets.

- Educational Resources: The platform offers various educational resources, such as articles and videos, to help, fractional shares, making it accessible for investors with limited budgets.

- Educational Resources: The platform offers various educational resources, such as articles and videos, to help usersFi,ional shares, making it accessible for investors with limited budgets.

- Educational Resources: The platform offers various educational resources, such as articles and videos, to help users learn aboutal shares, making it accessible for investors with limited budgets.

- Educational Resources: The platform offers various educational resources, such as articles and videos, to help users learn about investment strategieshares, making it accessible for investors with limited budgets.

- Educational Resources: The platform offers various educational resources, such as articles and videos, to help users learn about investment strategies,ares, making it accessible for investors with limited budgets.

- Educational Resources: The platform offers various educational resources, such as articles and videos, to help users learn about investment strategies, market, making it accessible for investors with limited budgets.

- Educational Resources: The platform offers various educational resources, such as articles and videos, to help users learn about investment strategies, market trends, it accessible for investors with limited budgets.

- Educational Resources: The platform offers various educational resources, such as articles and videos, to help users learn about investment strategies, market trends,ssible for investors with limited budgets.

- Educational Resources: The platform offers various educational resources, such as articles and videos, to help users learn about investment strategies, market trends, and risk resourcesith limited budgets.

- Educational Resources: The platform offers various educational resources, such as articles and videos, to help users learn about investment strategies, market trends, and risk management articlesdgets.

- Educational Resources: The platform offers various educational resources, such as articles and videos, to help users learn about investment strategies, market trends, and risk management.

3gets.

- Educational Resources: The platform offers various educational resources, such as articles and videos, to help users learn about investment strategies, market trends, and risk management.

-

* - Educational Resources:* The platform offers various educational resources, such as articles and videos, to help users learn about investment strategies, market trends, and risk management.

-

*F webEducational Resources: The platform offers various educational resources, such as articles and videos, to help users learn about investment strategies, market trends, and risk management.

-

*Fidelitytional Resources: The platform offers various educational resources, such as articles and videos, to help users learn about investment strategies, market trends, and risk management.

-

*Fidelity Bloom: andl Resources: The platform offers various educational resources, such as articles and videos, to help users learn about investment strategies, market trends, and risk management.

-

Fidelity Bloom: :* The platform offers various educational resources, such as articles and videos, to help users learn about investment strategies, market trends, and risk management.

-

Fidelity Bloom: The platform offers various educational resources, such as articles and videos, to help users learn about investment strategies, market trends, and risk management.

-

Fidelity Bloom: -he platform offers various educational resources, such as articles and videos, to help users learn about investment strategies, market trends, and risk management.

-

Fidelity Bloom:

-

- platform offers various educational resources, such as articles and videos, to help users learn about investment strategies, market trends, and risk management.

-

-

Fidelity Bloom:

- *Userorm offers various educational resources, such as articles and videos, to help users learn about investment strategies, market trends, and risk management.

-

Fidelity Bloom:

- *User-F various educational resources, such as articles and videos, to help users learn about investment strategies, market trends, and risk management.

-

Fidelity Bloom:

- *User-Friendlyious educational resources, such as articles and videos, to help users learn about investment strategies, market trends, and risk management.

-

Fidelity Bloom:

- *User-Friendly Interfaces educational resources, such as articles and videos, to help users learn about investment strategies, market trends, and risk management.

-

Fidelity Bloom:

- User-Friendly Interface:cational resources, such as articles and videos, to help users learn about investment strategies, market trends, and risk management.

-

Fidelity Bloom:

- User-Friendly Interface: Fal resources, such as articles and videos, to help users learn about investment strategies, market trends, and risk management.

-

Fidelity Bloom:

- User-Friendly Interface: Fidelityl resources, such as articles and videos, to help users learn about investment strategies, market trends, and risk management.

-

Fidelity Bloom:

- User-Friendly Interface: Fidelity Bloom, such as articles and videos, to help users learn about investment strategies, market trends, and risk management.

-

Fidelity Bloom:

- User-Friendly Interface: Fidelity Bloom isarticles and videos, to help users learn about investment strategies, market trends, and risk management.

-

Fidelity Bloom:

- User-Friendly Interface: Fidelity Bloom is tailoredrticles and videos, to help users learn about investment strategies, market trends, and risk management.

-

Fidelity Bloom:

- User-Friendly Interface: Fidelity Bloom is tailored for aboutvideos, to help users learn about investment strategies, market trends, and risk management.

-

Fidelity Bloom:

- User-Friendly Interface: Fidelity Bloom is tailored for newhelp users learn about investment strategies, market trends, and risk management.

-

Fidelity Bloom:

- User-Friendly Interface: Fidelity Bloom is tailored for new savlearn about investment strategies, market trends, and risk management.

-

Fidelity Bloom:

- User-Friendly Interface: Fidelity Bloom is tailored for new savers and marketout investment strategies, market trends, and risk management.

-

Fidelity Bloom:

- User-Friendly Interface: Fidelity Bloom is tailored for new savers and investorsestment strategies, market trends, and risk management.

-

Fidelity Bloom:

- User-Friendly Interface: Fidelity Bloom is tailored for new savers and investors, offeringstment strategies, market trends, and risk management.

-

Fidelity Bloom:

- User-Friendly Interface: Fidelity Bloom is tailored for new savers and investors, offering a user managements, market trends, and risk management.

-

Fidelity Bloom:

- User-Friendly Interface: Fidelity Bloom is tailored for new savers and investors, offering a user-friendly, market trends, and risk management.

-

Fidelity Bloom:

- User-Friendly Interface: Fidelity Bloom is tailored for new savers and investors, offering a user-friendly interfacerket trends, and risk management.

-

Fidelity Bloom:

- User-Friendly Interface: Fidelity Bloom is tailored for new savers and investors, offering a user-friendly interface ands, and risk management.

-

Fidelity Bloom:

- User-Friendly Interface: Fidelity Bloom is tailored for new savers and investors, offering a user-friendly interface and educationalsk management.

-

Fidelity Bloom:

- User-Friendly Interface: Fidelity Bloom is tailored for new savers and investors, offering a user-friendly interface and educational resources5anagement.

-

Fidelity Bloom:

- User-Friendly Interface: Fidelity Bloom is tailored for new savers and investors, offering a user-friendly interface and educational resources. nagement.

-

Fidelity Bloom:

- User-Friendly Interface: Fidelity Bloom is tailored for new savers and investors, offering a user-friendly interface and educational resources. ement.

-

Fidelity Bloom:

- User-Friendly Interface: Fidelity Bloom is tailored for new savers and investors, offering a user-friendly interface and educational resources. -t.

-

Fidelity Bloom:

- User-Friendly Interface: Fidelity Bloom is tailored for new savers and investors, offering a user-friendly interface and educational resources.

- *

-

Fidelity Bloom:

- User-Friendly Interface: Fidelity Bloom is tailored for new savers and investors, offering a user-friendly interface and educational resources.

- *NFidelity Bloom:**

- User-Friendly Interface: Fidelity Bloom is tailored for new savers and investors, offering a user-friendly interface and educational resources.

- *Nudoom:**

- User-Friendly Interface: Fidelity Bloom is tailored for new savers and investors, offering a user-friendly interface and educational resources.

- *Nudgesm:**

- User-Friendly Interface: Fidelity Bloom is tailored for new savers and investors, offering a user-friendly interface and educational resources.

- *Nudges and**

- User-Friendly Interface: Fidelity Bloom is tailored for new savers and investors, offering a user-friendly interface and educational resources.

- *Nudges and Challenges

- User-Friendly Interface: Fidelity Bloom is tailored for new savers and investors, offering a user-friendly interface and educational resources.

- Nudges and Challenges: - User-Friendly Interface: Fidelity Bloom is tailored for new savers and investors, offering a user-friendly interface and educational resources.

- Nudges and Challenges: TheUser-Friendly Interface:* Fidelity Bloom is tailored for new savers and investors, offering a user-friendly interface and educational resources.

- Nudges and Challenges: The platformdly Interface:* Fidelity Bloom is tailored for new savers and investors, offering a user-friendly interface and educational resources.

- Nudges and Challenges: The platform incorporatesace:* Fidelity Bloom is tailored for new savers and investors, offering a user-friendly interface and educational resources.

- Nudges and Challenges: The platform incorporates behavioral Fidelity Bloom is tailored for new savers and investors, offering a user-friendly interface and educational resources.

- Nudges and Challenges: The platform incorporates behavioral science Bloom is tailored for new savers and investors, offering a user-friendly interface and educational resources.

- Nudges and Challenges: The platform incorporates behavioral science withailored for new savers and investors, offering a user-friendly interface and educational resources.

- Nudges and Challenges: The platform incorporates behavioral science with nud cateror new savers and investors, offering a user-friendly interface and educational resources.

- Nudges and Challenges: The platform incorporates behavioral science with nudgesnew savers and investors, offering a user-friendly interface and educational resources.

- Nudges and Challenges: The platform incorporates behavioral science with nudges and challengesers and investors, offering a user-friendly interface and educational resources.

- Nudges and Challenges: The platform incorporates behavioral science with nudges and challenges,vestors, offering a user-friendly interface and educational resources.

- Nudges and Challenges: The platform incorporates behavioral science with nudges and challenges, encouraging making offering a user-friendly interface and educational resources.

- Nudges and Challenges: The platform incorporates behavioral science with nudges and challenges, encouraging usersfering a user-friendly interface and educational resources.

- Nudges and Challenges: The platform incorporates behavioral science with nudges and challenges, encouraging users tog a user-friendly interface and educational resources.

- Nudges and Challenges: The platform incorporates behavioral science with nudges and challenges, encouraging users to developuser-friendly interface and educational resources.

- Nudges and Challenges: The platform incorporates behavioral science with nudges and challenges, encouraging users to develop good financialfriendly interface and educational resources.

- Nudges and Challenges: The platform incorporates behavioral science with nudges and challenges, encouraging users to develop good financial habits. endly interface and educational resources.

- Nudges and Challenges: The platform incorporates behavioral science with nudges and challenges, encouraging users to develop good financial habits. andce and educational resources.

- Nudges and Challenges: The platform incorporates behavioral science with nudges and challenges, encouraging users to develop good financial habits. -ducational resources.

- Nudges and Challenges: The platform incorporates behavioral science with nudges and challenges, encouraging users to develop good financial habits.

- *tional resources.

- Nudges and Challenges: The platform incorporates behavioral science with nudges and challenges, encouraging users to develop good financial habits.

- *Multipleal resources.

- Nudges and Challenges: The platform incorporates behavioral science with nudges and challenges, encouraging users to develop good financial habits.

- *Multiple Broker resources.

- Nudges and Challenges: The platform incorporates behavioral science with nudges and challenges, encouraging users to develop good financial habits.

- *Multiple Brokerages.

- Nudges and Challenges: The platform incorporates behavioral science with nudges and challenges, encouraging users to develop good financial habits.

- *Multiple Brokerage Accounts

- Nudges and Challenges: The platform incorporates behavioral science with nudges and challenges, encouraging users to develop good financial habits.

- Multiple Brokerage Accounts: - Nudges and Challenges: The platform incorporates behavioral science with nudges and challenges, encouraging users to develop good financial habits.

- Multiple Brokerage Accounts: F- Nudges and Challenges: The platform incorporates behavioral science with nudges and challenges, encouraging users to develop good financial habits.

- Multiple Brokerage Accounts: Fidelity includellenges:* The platform incorporates behavioral science with nudges and challenges, encouraging users to develop good financial habits.

- Multiple Brokerage Accounts: Fidelity Bloomnges:* The platform incorporates behavioral science with nudges and challenges, encouraging users to develop good financial habits.

- Multiple Brokerage Accounts: Fidelity Bloom providess:* The platform incorporates behavioral science with nudges and challenges, encouraging users to develop good financial habits.

- Multiple Brokerage Accounts: Fidelity Bloom provides two:* The platform incorporates behavioral science with nudges and challenges, encouraging users to develop good financial habits.

- Multiple Brokerage Accounts: Fidelity Bloom provides two brokerage platform incorporates behavioral science with nudges and challenges, encouraging users to develop good financial habits.

- Multiple Brokerage Accounts: Fidelity Bloom provides two brokerage accountstform incorporates behavioral science with nudges and challenges, encouraging users to develop good financial habits.

- Multiple Brokerage Accounts: Fidelity Bloom provides two brokerage accounts – Saveform incorporates behavioral science with nudges and challenges, encouraging users to develop good financial habits.

- Multiple Brokerage Accounts: Fidelity Bloom provides two brokerage accounts – Save andrm incorporates behavioral science with nudges and challenges, encouraging users to develop good financial habits.

- Multiple Brokerage Accounts: Fidelity Bloom provides two brokerage accounts – Save and Spendrporates behavioral science with nudges and challenges, encouraging users to develop good financial habits.

- Multiple Brokerage Accounts: Fidelity Bloom provides two brokerage accounts – Save and Spend –es behavioral science with nudges and challenges, encouraging users to develop good financial habits.

- Multiple Brokerage Accounts: Fidelity Bloom provides two brokerage accounts – Save and Spend – allowings behavioral science with nudges and challenges, encouraging users to develop good financial habits.

- Multiple Brokerage Accounts: Fidelity Bloom provides two brokerage accounts – Save and Spend – allowing usersornsioral science with nudges and challenges, encouraging users to develop good financial habits.

- Multiple Brokerage Accounts: Fidelity Bloom provides two brokerage accounts – Save and Spend – allowing users tooral science with nudges and challenges, encouraging users to develop good financial habits.

- Multiple Brokerage Accounts: Fidelity Bloom provides two brokerage accounts – Save and Spend – allowing users to transferience with nudges and challenges, encouraging users to develop good financial habits.

- Multiple Brokerage Accounts: Fidelity Bloom provides two brokerage accounts – Save and Spend – allowing users to transfer funds, with nudges and challenges, encouraging users to develop good financial habits.

- Multiple Brokerage Accounts: Fidelity Bloom provides two brokerage accounts – Save and Spend – allowing users to transfer funds between Schwab Mobile.

-

**Robo-Advisging users to develop good financial habits.

- Multiple Brokerage Accounts: Fidelity Bloom provides two brokerage accounts – Save and Spend – allowing users to transfer funds between them tog users to develop good financial habits.

- Multiple Brokerage Accounts: Fidelity Bloom provides two brokerage accounts – Save and Spend – allowing users to transfer funds between them to achieve their savingusers to develop good financial habits.

- Multiple Brokerage Accounts: Fidelity Bloom provides two brokerage accounts – Save and Spend – allowing users to transfer funds between them to achieve their saving goalsers to develop good financial habits.

- Multiple Brokerage Accounts: Fidelity Bloom provides two brokerage accounts – Save and Spend – allowing users to transfer funds between them to achieve their saving goals.

s to develop good financial habits.

- Multiple Brokerage Accounts: Fidelity Bloom provides two brokerage accounts – Save and Spend – allowing users to transfer funds between them to achieve their saving goals.

4to develop good financial habits.

- Multiple Brokerage Accounts: Fidelity Bloom provides two brokerage accounts – Save and Spend – allowing users to transfer funds between them to achieve their saving goals.

4.lop good financial habits.

- Multiple Brokerage Accounts: Fidelity Bloom provides two brokerage accounts – Save and Spend – allowing users to transfer funds between them to achieve their saving goals.

-

**good financial habits.

- Multiple Brokerage Accounts: Fidelity Bloom provides two brokerage accounts – Save and Spend – allowing users to transfer funds between them to achieve their saving goals.

-

**Invstr:d financial habits.

- Multiple Brokerage Accounts: Fidelity Bloom provides two brokerage accounts – Save and Spend – allowing users to transfer funds between them to achieve their saving goals.

-

Invstr: as anhabits.

- Multiple Brokerage Accounts: Fidelity Bloom provides two brokerage accounts – Save and Spend – allowing users to transfer funds between them to achieve their saving goals.

-

Invstr:

- Multiple Brokerage Accounts: Fidelity Bloom provides two brokerage accounts – Save and Spend – allowing users to transfer funds between them to achieve their saving goals.

-

Invstr:

- Educational Features: Invstr caters to new aMultiple Brokerage Accounts: Fidelity Bloom provides two brokerage accounts – Save and Spend – allowing users to transfer funds between them to achieve their saving goals.

-

Invstr:

- Educational Features: Invstr caters to new investors Brokerage Accounts:* Fidelity Bloom provides two brokerage accounts – Save and Spend – allowing users to transfer funds between them to achieve their saving goals.

-

Invstr:

- Educational Features: Invstr caters to new investors witherage Accounts:* Fidelity Bloom provides two brokerage accounts – Save and Spend – allowing users to transfer funds between them to achieve their saving goals.

-

Invstr:

- Educational Features: Invstr caters to new investors with a rots:* Fidelity Bloom provides two brokerage accounts – Save and Spend – allowing users to transfer funds between them to achieve their saving goals.

-

Invstr:

- Educational Features: Invstr caters to new investors with a variety-advisors toBloom provides two brokerage accounts – Save and Spend – allowing users to transfer funds between them to achieve their saving goals.

-

Invstr:

- Educational Features: Invstr caters to new investors with a variety ofrovides two brokerage accounts – Save and Spend – allowing users to transfer funds between them to achieve their saving goals.

-

Invstr:

- Educational Features: Invstr caters to new investors with a variety of features brokerage accounts – Save and Spend – allowing users to transfer funds between them to achieve their saving goals.

-

Invstr:

- Educational Features: Invstr caters to new investors with a variety of features,accounts – Save and Spend – allowing users to transfer funds between them to achieve their saving goals.

-

Invstr:

- Educational Features: Invstr caters to new investors with a variety of features, includingcounts – Save and Spend – allowing users to transfer funds between them to achieve their saving goals.

-

Invstr:

- Educational Features: Invstr caters to new investors with a variety of features, including aunts – Save and Spend – allowing users to transfer funds between them to achieve their saving goals.

-

Invstr:

- Educational Features: Invstr caters to new investors with a variety of features, including a large Rob Save and Spend – allowing users to transfer funds between them to achieve their saving goals.

-

Invstr:

- Educational Features: Invstr caters to new investors with a variety of features, including a large communitySave and Spend – allowing users to transfer funds between them to achieve their saving goals.

-

Invstr:

- Educational Features: Invstr caters to new investors with a variety of features, including a large community,e and Spend – allowing users to transfer funds between them to achieve their saving goals.

-

Invstr:

- Educational Features: Invstr caters to new investors with a variety of features, including a large community, educationalnd Spend – allowing users to transfer funds between them to achieve their saving goals.

-

Invstr:

- Educational Features: Invstr caters to new investors with a variety of features, including a large community, educational materials employ allowing users to transfer funds between them to achieve their saving goals.

-

Invstr:

- Educational Features: Invstr caters to new investors with a variety of features, including a large community, educational materials,sers to transfer funds between them to achieve their saving goals.

-

Invstr:

- Educational Features: Invstr caters to new investors with a variety of features, including a large community, educational materials, and to transfer funds between them to achieve their saving goals.

-

Invstr:

- Educational Features: Invstr caters to new investors with a variety of features, including a large community, educational materials, and a simulated expertise tobetween them to achieve their saving goals.

-

Invstr:

- Educational Features: Invstr caters to new investors with a variety of features, including a large community, educational materials, and a simulated stock trading game. them to achieve their saving goals.

-

Invstr:

- Educational Features: Invstr caters to new investors with a variety of features, including a large community, educational materials, and a simulated stock trading game.

- *eve their saving goals.

-

Invstr:

- Educational Features: Invstr caters to new investors with a variety of features, including a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The appaving goals.

-

Invstr:

- Educational Features: Invstr caters to new investors with a variety of features, including a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a communitygoals.

-

Invstr:

- Educational Features: Invstr caters to new investors with a variety of features, including a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing

-

Invstr:

- Educational Features: Invstr caters to new investors with a variety of features, including a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact. Invstr:

- Educational Features: Invstr caters to new investors with a variety of features, including a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact,vstr:**

- Educational Features: Invstr caters to new investors with a variety of features, including a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, sharestr:**

- Educational Features: Invstr caters to new investors with a variety of features, including a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences- Educational Features: Invstr caters to new investors with a variety of features, including a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences,cational Features:* Invstr caters to new investors with a variety of features, including a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights risk tolerance,:* Invstr caters to new investors with a variety of features, including a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights fromnvstr caters to new investors with a variety of features, including a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others. .

to new investors with a variety of features, including a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- *to new investors with a variety of features, including a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- *Webo new investors with a variety of features, including a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- *Webinarsew investors with a variety of features, including a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- *Webinars andestors with a variety of features, including a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- *Webinars and Resourcesith a variety of features, including a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- Webinars and Resources: Invh a variety of features, including a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- Webinars and Resources: Invstra variety of features, including a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- Webinars and Resources: Invstr offersvariety of features, including a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- Webinars and Resources: Invstr offers additionalriety of features, including a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- Webinars and Resources: Invstr offers additional resourcesFi of features, including a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- Webinars and Resources: Invstr offers additional resources liketures, including a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- Webinars and Resources: Invstr offers additional resources like webres, including a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- Webinars and Resources: Invstr offers additional resources like webinarscluding a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- Webinars and Resources: Invstr offers additional resources like webinars,a large community, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- Webinars and Resources: Invstr offers additional resources like webinars, videoscommunity, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- Webinars and Resources: Invstr offers additional resources like webinars, videos,nity, educational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- Webinars and Resources: Invstr offers additional resources like webinars, videos, andducational materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- Webinars and Resources: Invstr offers additional resources like webinars, videos, and articlesonal materials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- Webinars and Resources: Invstr offers additional resources like webinars, videos, and articles, covering various aspects of followials, and a simulated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- Webinars and Resources: Invstr offers additional resources like webinars, videos, and articles, covering various aspects of investing investors,ated stock trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- Webinars and Resources: Invstr offers additional resources like webinars, videos, and articles, covering various aspects of investing.

5ck trading game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- Webinars and Resources: Invstr offers additional resources like webinars, videos, and articles, covering various aspects of investing.

-

**ding game.

- Community Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- Webinars and Resources: Invstr offers additional resources like webinars, videos, and articles, covering various aspects of investing.

-

*So activitiesmmunity Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- Webinars and Resources: Invstr offers additional resources like webinars, videos, and articles, covering various aspects of investing.

-

*SoFimunity Interaction: The app fosters a community of investors, allowing users to interact, share experiences, and get insights from others.

- Webinars and Resources: Invstr offers additional resources like webinars, videos, and articles, covering various aspects of investing.

-